Is united healthcare better than blue cross blue shield – Is UnitedHealthcare better than Blue Cross Blue Shield? This is a question that many people ask when they are shopping for health insurance. Both companies offer a variety of plans, so it is important to compare them carefully to find the one that is right for you.

In this article, we will compare the coverage, provider networks, premiums, customer service, and technology of UnitedHealthcare and Blue Cross Blue Shield to help you make an informed decision.

Coverage and Benefits

UnitedHealthcare and Blue Cross Blue Shield offer comprehensive health insurance plans with varying coverage and benefits. Understanding these differences is crucial for making an informed decision.

Both providers offer a range of plans with different deductibles, copayments, and coinsurance. Deductibles represent the amount you pay out-of-pocket before insurance coverage begins. Copayments are fixed amounts you pay for specific services, such as doctor visits or prescription drugs.

Coinsurance, on the other hand, is a percentage of the cost you share after meeting your deductible.

While comparing the benefits of United Healthcare and Blue Cross Blue Shield, it’s essential to consider specific health concerns. For instance, if you’re experiencing blood in urine after radiation therapy for prostate cancer, it’s crucial to consult a healthcare professional promptly.

You can find more information about this condition at here . Returning to the comparison, both United Healthcare and Blue Cross Blue Shield offer comprehensive coverage, but their specific benefits and premiums may vary depending on your individual needs.

Deductibles

- UnitedHealthcare plans typically have lower deductibles compared to Blue Cross Blue Shield plans.

- For example, UnitedHealthcare’s Bronze plan has a deductible of $1,500, while Blue Cross Blue Shield’s Bronze plan has a deductible of $2,500.

Copayments

- Copayments for doctor visits and prescription drugs vary between the two providers.

- UnitedHealthcare plans generally have higher copayments for specialist visits compared to Blue Cross Blue Shield plans.

- For instance, UnitedHealthcare may charge a $40 copayment for a specialist visit, while Blue Cross Blue Shield may charge a $25 copayment for the same service.

Coinsurance

- Coinsurance rates after meeting the deductible also differ between UnitedHealthcare and Blue Cross Blue Shield plans.

- UnitedHealthcare plans typically have lower coinsurance rates for in-network providers compared to Blue Cross Blue Shield plans.

- For example, UnitedHealthcare may have a 10% coinsurance rate for in-network hospital stays, while Blue Cross Blue Shield may have a 15% coinsurance rate for the same service.

Covered Services

- Both UnitedHealthcare and Blue Cross Blue Shield cover a wide range of medical services and procedures.

- UnitedHealthcare plans may offer additional coverage for certain services, such as mental health and substance abuse treatment.

- Blue Cross Blue Shield plans may have stronger networks of in-network providers, providing access to a wider range of healthcare professionals.

Provider Networks

The size and scope of provider networks are crucial factors to consider when choosing a health insurance plan. UnitedHealthcare and Blue Cross Blue Shield offer extensive provider networks, but there are some key differences between the two.

UnitedHealthcare has a vast network of over 1.3 million healthcare providers, including doctors, hospitals, and other healthcare facilities. This network is particularly strong in urban areas, where UnitedHealthcare has a wide range of specialists and primary care physicians. However, UnitedHealthcare’s network may be more limited in rural areas.

Blue Cross Blue Shield also has a large provider network, with over 900,000 healthcare providers. Blue Cross Blue Shield’s network is particularly strong in suburban and rural areas, where it has a wide range of primary care physicians and hospitals.

However, Blue Cross Blue Shield’s network may be more limited in urban areas.

Availability of Specialists

Both UnitedHealthcare and Blue Cross Blue Shield offer a wide range of specialists, including cardiologists, oncologists, and pediatricians. However, the availability of specialists may vary depending on the location and the specific plan you choose.

Availability of Primary Care Physicians

Both UnitedHealthcare and Blue Cross Blue Shield offer a wide range of primary care physicians, including family doctors, internists, and pediatricians. However, the availability of primary care physicians may vary depending on the location and the specific plan you choose.

Availability of Hospitals

Both UnitedHealthcare and Blue Cross Blue Shield offer a wide range of hospitals, including teaching hospitals, community hospitals, and specialty hospitals. However, the availability of hospitals may vary depending on the location and the specific plan you choose.

Premiums and Costs

When comparing UnitedHealthcare and Blue Cross Blue Shield, it’s essential to consider the financial implications. This includes the monthly premiums and out-of-pocket costs associated with each plan.

Premiums vary based on factors such as location, age, plan type, and deductible. In general, UnitedHealthcare plans tend to have lower monthly premiums compared to Blue Cross Blue Shield plans. However, it’s important to note that premiums may also vary depending on the specific plan options chosen.

Out-of-Pocket Costs

Out-of-pocket costs refer to the expenses you pay directly for medical services, such as deductibles, copays, and coinsurance. These costs can vary significantly between UnitedHealthcare and Blue Cross Blue Shield plans.

- Deductibles:The deductible is the amount you must pay out-of-pocket before your insurance coverage begins. UnitedHealthcare plans typically have higher deductibles compared to Blue Cross Blue Shield plans.

- Copays:Copayments are fixed amounts you pay for specific medical services, such as doctor’s visits or prescription drugs. Copay amounts can vary between UnitedHealthcare and Blue Cross Blue Shield plans.

- Coinsurance:Coinsurance is the percentage of the cost of a medical service that you pay after you meet your deductible. Coinsurance rates can vary between UnitedHealthcare and Blue Cross Blue Shield plans.

When choosing between UnitedHealthcare and Blue Cross Blue Shield, it’s important to carefully compare the premiums and out-of-pocket costs to determine which plan best meets your financial needs and healthcare requirements.

Customer Service and Support

Evaluating the customer service and support offered by UnitedHealthcare and Blue Cross Blue Shield is crucial for understanding the overall experience of policyholders. This includes assessing the responsiveness, helpfulness, and accessibility of customer service representatives.

Both UnitedHealthcare and Blue Cross Blue Shield provide customer service through multiple channels, including phone, email, and online chat. UnitedHealthcare offers a 24/7 customer service hotline, while Blue Cross Blue Shield’s customer service is available during business hours.

When comparing United Healthcare and Blue Cross Blue Shield, it’s important to consider your specific needs and preferences. Both providers offer a range of plans, so it’s worth exploring laser hair removal on your head options to find the best fit for you.

Additionally, factors such as premiums, coverage, and provider networks should be taken into account to make an informed decision.

Responsiveness

When it comes to responsiveness, UnitedHealthcare generally has a faster response time compared to Blue Cross Blue Shield. Policyholders report shorter wait times when calling the customer service hotline and receiving email replies.

Helpfulness

In terms of helpfulness, both UnitedHealthcare and Blue Cross Blue Shield provide knowledgeable and friendly customer service representatives. They are able to answer questions, resolve issues, and provide guidance on various aspects of health insurance coverage.

Accessibility

Regarding accessibility, UnitedHealthcare has a wider range of customer service channels compared to Blue Cross Blue Shield. In addition to phone, email, and online chat, UnitedHealthcare also offers a mobile app and self-service portal, allowing policyholders to access their account information and make changes on their own.

Technology and Digital Tools

When comparing UnitedHealthcare and Blue Cross Blue Shield, their digital offerings play a crucial role in enhancing the member experience. Both companies provide online portals, mobile apps, and various tools to simplify healthcare management.

UnitedHealthcare’s online portal, MyUHC, offers a user-friendly interface with features like secure messaging, appointment scheduling, and claims tracking. The mobile app, UHC, extends these functionalities, allowing members to access their health information, find providers, and pay their premiums on the go.

Mobile Apps

Both UnitedHealthcare and Blue Cross Blue Shield offer mobile apps that provide convenient access to healthcare information and services.

- UnitedHealthcare (UHC):The UHC app offers a comprehensive range of features, including secure messaging, appointment scheduling, prescription refills, and access to virtual care. It also includes a wellness tracker and personalized health recommendations.

- Blue Cross Blue Shield (BCBS):The BCBS mobile app provides similar features, such as secure messaging, appointment scheduling, and claims tracking. It also includes a feature called “Blue Connect,” which allows members to connect with other BCBS members for support and advice.

Plan Types and Options

UnitedHealthcare and Blue Cross Blue Shield offer a range of plan types and options to meet the diverse needs of individuals and families. These plans vary in terms of coverage, provider networks, and costs.

HMOs vs. PPOs, Is united healthcare better than blue cross blue shield

- HMOs (Health Maintenance Organizations):HMOs require members to choose a primary care physician (PCP) who coordinates their care. Members must stay within the HMO’s network of providers, except in cases of emergency or referral. HMOs typically offer lower premiums than PPOs.

- PPOs (Preferred Provider Organizations):PPOs allow members to choose any provider within the network, including specialists. They offer more flexibility than HMOs but may have higher premiums.

Other Plan Types

In addition to HMOs and PPOs, UnitedHealthcare and Blue Cross Blue Shield offer other plan types, including:

- EPOs (Exclusive Provider Organizations):EPOs are similar to HMOs but offer a more limited network of providers. They typically have lower premiums than PPOs.

- POS (Point-of-Service Plans):POS plans combine features of HMOs and PPOs. Members can choose to see providers within the network or outside the network, but out-of-network care may cost more.

- High-Deductible Health Plans (HDHPs):HDHPs have lower premiums but higher deductibles. They may be paired with a Health Savings Account (HSA) to save for medical expenses.

Employer and Group Plans: Is United Healthcare Better Than Blue Cross Blue Shield

UnitedHealthcare and Blue Cross Blue Shield offer comprehensive group health plans for employers and their employees. Both providers have their strengths and weaknesses, so it’s important to compare them thoroughly before making a decision.

Benefits for Employers

- Both UnitedHealthcare and Blue Cross Blue Shield offer a wide range of plan options to meet the needs of different businesses.

- Both providers have a strong track record of providing quality healthcare services.

- Both providers offer competitive rates and discounts for group plans.

Benefits for Employees

- Both UnitedHealthcare and Blue Cross Blue Shield offer a wide range of benefits, including medical, dental, vision, and prescription drug coverage.

- Both providers have a large network of providers, so employees have access to quality care wherever they live.

- Both providers offer a variety of wellness programs to help employees stay healthy.

Drawbacks

- UnitedHealthcare has a smaller provider network than Blue Cross Blue Shield, which could be a disadvantage for employees who live in rural areas.

- Blue Cross Blue Shield has higher premiums than UnitedHealthcare, which could be a disadvantage for employers with limited budgets.

Overall, both UnitedHealthcare and Blue Cross Blue Shield offer quality group health plans. Employers and employees should carefully consider the benefits and drawbacks of each plan before making a decision.

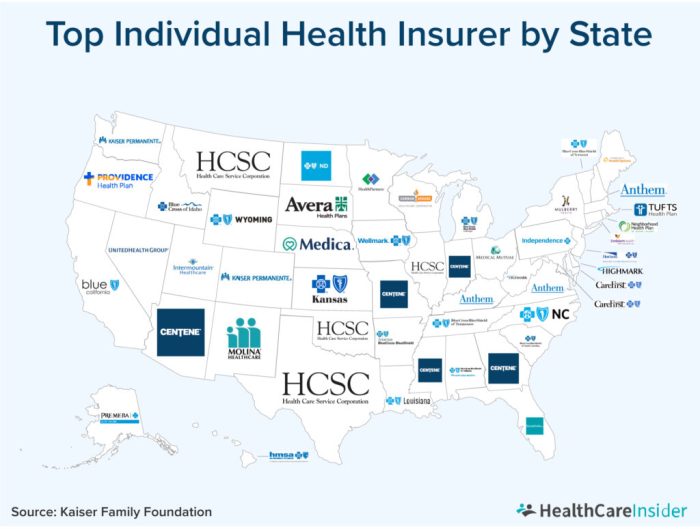

State-Specific Variations

UnitedHealthcare and Blue Cross Blue Shield plans exhibit variations across different states due to state regulations and market conditions. These variations can impact coverage, costs, and the overall healthcare experience for members.

State regulations play a significant role in shaping health insurance plans. For instance, some states mandate certain benefits or coverage levels, while others allow insurers more flexibility in plan design. These regulations can influence the scope of coverage offered by UnitedHealthcare and Blue Cross Blue Shield plans in different states.

Market Conditions

Market conditions, such as the presence of local competitors and the size of the insured population, can also affect the offerings of UnitedHealthcare and Blue Cross Blue Shield. In states with a competitive insurance market, insurers may offer more competitive premiums and benefits to attract customers.

Additionally, the size of the insured population can influence the availability of certain plans and the level of coverage provided.

Financial Stability and Reputation

UnitedHealthcare and Blue Cross Blue Shield (BCBS) are both well-established and financially stable insurance providers. They consistently rank among the top health insurers in the United States, with strong financial performance, high customer satisfaction ratings, and numerous industry awards.

When it comes to comparing United Healthcare and Blue Cross Blue Shield, both offer extensive coverage options. However, if you’re looking for specific information on pelvic ultrasound costs without insurance, you can find valuable insights here . Returning to our comparison, it’s important to assess your individual healthcare needs and preferences to determine which provider aligns better with your situation.

Financial Performance

UnitedHealthcare has a strong financial foundation with high revenue and earnings. In 2022, the company reported an annual revenue of over $288 billion and a net income of $17.3 billion. BCBS also has a solid financial position, with its 36 independent member companies collectively generating over $133 billion in revenue in 2022.

Customer Satisfaction Ratings

Both UnitedHealthcare and BCBS have received high customer satisfaction ratings. According to the National Committee for Quality Assurance (NCQA), UnitedHealthcare has consistently earned 4.5 out of 5 stars in customer satisfaction, while BCBS has also received high ratings from J.D.

Power and Associates.

Industry Awards

UnitedHealthcare and BCBS have received numerous industry awards and recognitions. UnitedHealthcare has been named one of the “World’s Most Admired Companies” by Fortune magazine, while BCBS has been recognized as a “Best Place to Work” by Glassdoor.

Summary and Recommendations

UnitedHealthcare and Blue Cross Blue Shield (BCBS) are both reputable health insurance providers with extensive coverage networks and a wide range of plan options. However, there are some key differences between the two companies that may influence your decision when choosing a health insurance plan.

Ultimately, the best health insurance provider for you will depend on your specific needs and preferences. If you’re looking for a provider with a wide network of providers and a strong reputation, either UnitedHealthcare or BCBS would be a good choice.

However, if you’re looking for a more affordable option or if you have a specific health condition, you may want to compare plans from both companies to find the one that best meets your needs.

Recommendations

- If you’re looking for a health insurance provider with a wide network of providers, either UnitedHealthcare or BCBS would be a good choice.

- If you’re looking for a more affordable option, UnitedHealthcare may be a better choice than BCBS.

- If you have a specific health condition, you may want to compare plans from both companies to find the one that best meets your needs.

Final Wrap-Up

Ultimately, the best way to decide which health insurance company is right for you is to compare the plans that they offer and choose the one that best meets your needs. Both UnitedHealthcare and Blue Cross Blue Shield offer a variety of plans, so you should be able to find one that fits your budget and your health care needs.

Popular Questions

What is the difference between UnitedHealthcare and Blue Cross Blue Shield?

UnitedHealthcare and Blue Cross Blue Shield are two of the largest health insurance companies in the United States. Both companies offer a variety of health insurance plans, but there are some key differences between the two companies.

Which company has a better provider network?

Both UnitedHealthcare and Blue Cross Blue Shield have large provider networks. However, the specific providers that are available in each network vary depending on your location.

Which company has lower premiums?

The premiums for UnitedHealthcare and Blue Cross Blue Shield plans vary depending on the plan that you choose and your location. However, in general, UnitedHealthcare plans tend to have lower premiums than Blue Cross Blue Shield plans.